Hey there, Game Kreatif! Ever wondered about ditching your credit card and paying for that new game skin with Bitcoin? The world of online payments is constantly evolving, and cryptocurrency has emerged as a fascinating contender. This article dives deep into the potential and challenges of using cryptocurrency as an online payment method, exploring everything from its lightning-fast transaction speeds to the complexities of regulation. Get ready to unravel the mysteries of crypto payments and discover whether this digital currency revolution is the future of online transactions.

The Alluring Potential of Crypto Payments

Speed and Efficiency: Say Goodbye to Waiting

Traditional payment methods can be slow, often involving intermediaries and processing delays. Cryptocurrency transactions, however, can be significantly faster. Imagine purchasing an item online and having it delivered almost instantly because the payment confirmation was near-instantaneous. This speed and efficiency are a major draw for both consumers and businesses. Think about buying a limited edition collectible or snapping up concert tickets before they sell out – crypto can give you that edge.

Cryptocurrency’s decentralized nature further enhances this speed. Transactions occur directly between the buyer and seller, cutting out the middleman and streamlining the process. This also reduces the risk of errors and delays that can occur with traditional payment systems.

Lower Transaction Fees: Keeping More of Your Money

Another attractive aspect of cryptocurrency as an online payment method is the potential for lower transaction fees. Traditional payment processors often charge a percentage of the transaction amount, which can eat into profits for businesses and add up for consumers. Crypto transactions, while sometimes having fees depending on the network and current demand, often have significantly lower fees than traditional methods. This is particularly beneficial for international transactions, where traditional banking fees can be quite high.

Consider a small business owner selling their products globally. With cryptocurrency, they can receive payments from international customers without losing a large chunk of their revenue to transaction fees. This opens up new markets and opportunities for small businesses and freelancers.

Enhanced Security and Transparency: Protecting Your Finances

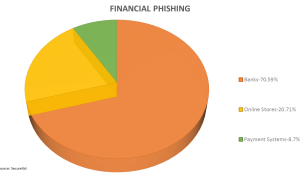

Cryptocurrency transactions are secured by cryptography, making them highly resistant to fraud and chargebacks. Once a transaction is confirmed on the blockchain, it’s virtually impossible to reverse or alter. This immutability provides a high level of security for both buyers and sellers. For businesses, this means reduced risk of fraudulent chargebacks, which can be a significant problem with traditional credit card payments.

The transparency of the blockchain also adds another layer of security. All transactions are recorded on a public ledger, allowing anyone to verify their authenticity. This transparency can increase trust and accountability in online transactions.

The Challenges of Crypto Payments

Volatility: Riding the Rollercoaster

One of the biggest challenges facing cryptocurrency as an online payment method is its price volatility. The value of cryptocurrencies can fluctuate dramatically, making it difficult for businesses to accept them as payment. Imagine selling a product for a certain amount of Bitcoin, only to have its value drop significantly by the time you convert it to your local currency. This volatility creates uncertainty and risk for businesses.

For consumers, volatility can also be a deterrent. While the price could increase, there’s also the risk of its value decreasing after purchase, making the purchased goods effectively more expensive in hindsight. This instability can make budgeting and financial planning challenging.

Regulation and Legal Uncertainty: Navigating the Grey Area

The regulatory landscape surrounding cryptocurrency is still evolving, creating uncertainty for businesses and consumers. Different countries have different approaches to regulating cryptocurrency, and the lack of clear guidelines can make it difficult for businesses to navigate this complex environment. This uncertainty can stifle innovation and adoption of crypto payments.

This ambiguity can be a barrier for consumers too. Without clear legal frameworks, there are concerns about consumer protection and recourse in case of disputes or fraud. This uncertainty makes some hesitant to adopt cryptocurrencies as a regular payment method.

User Experience and Accessibility: Simplifying the Complex

Using cryptocurrency requires a certain level of technical understanding, which can be a barrier for many users. Setting up a cryptocurrency wallet, understanding private keys, and navigating different blockchain platforms can be daunting for those unfamiliar with the technology. Improving the user experience and making cryptocurrency more accessible is crucial for wider adoption.

The current user interface for many crypto wallets and exchanges can be confusing and intimidating. Simplifying the process of buying, storing, and using cryptocurrency is essential to making it a mainstream payment method. Imagine trying to explain blockchain technology to your grandma – it needs to be much simpler than that!

Bridging the Gap: Addressing the Challenges

Stablecoins: A Solution to Volatility?

Stablecoins, pegged to stable assets like the US dollar, aim to mitigate the volatility issue. They offer the benefits of cryptocurrency, such as faster transactions and lower fees, without the dramatic price swings. This could make stablecoins a more viable option for online payments.

However, even stablecoins are not without their challenges. Maintaining their peg to the underlying asset requires careful management and reserves, and there are ongoing debates about their transparency and regulatory oversight.

Regulatory Clarity: Paving the Way for Adoption

Increased regulatory clarity is essential for fostering trust and encouraging wider adoption of cryptocurrency payments. Clear guidelines and frameworks can provide businesses with the certainty they need to invest in cryptocurrency infrastructure and integrate it into their payment systems.

Consumer protection measures are also crucial. Regulations need to address issues like dispute resolution, fraud prevention, and the security of user funds. This will help build confidence in cryptocurrency as a safe and reliable payment method.

User-Friendly Interfaces: Making Crypto Accessible to Everyone

Developing user-friendly wallets and platforms is key to making cryptocurrency more accessible to the average consumer. Intuitive interfaces, simplified processes, and educational resources can empower more people to use cryptocurrency for online payments.

Imagine a payment app that seamlessly integrates cryptocurrency payments alongside traditional methods, allowing users to choose their preferred option with a simple click. This level of integration is crucial for mass adoption.

Cryptocurrency as an Online Payment Method: Potential and Challenges – A Detailed Breakdown

| Feature | Potential Benefits | Challenges |

|---|---|---|

| Speed | Faster transaction times, especially for international payments | Volatility can create uncertainty in transaction value |

| Cost | Lower transaction fees compared to traditional methods | Network congestion can lead to unpredictable fees |

| Security | Enhanced security through cryptography and blockchain technology | Security vulnerabilities in wallets and exchanges are a concern |

| Transparency | Publicly verifiable transactions on the blockchain | Lack of privacy in some cases can be a drawback |

| Accessibility | Potential for financial inclusion in underserved communities | Technical complexity and user experience can be barriers to entry |

| Regulation | Potential for reduced reliance on traditional financial institutions | Unclear regulatory landscape creates uncertainty and hinders adoption |

Conclusion

Cryptocurrency as an online payment method holds immense potential to revolutionize the way we transact online. From faster transactions and lower fees to enhanced security and transparency, the benefits are undeniable. However, challenges such as volatility, regulation, and user experience need to be addressed before cryptocurrency can become a mainstream payment option. The future of crypto payments remains exciting, and as the technology evolves and matures, it will be fascinating to see how it shapes the future of commerce. Want to explore more about the future of finance? Check out our other articles on [link to related article 1] and [link to related article 2]. Thanks for reading, Game Kreatif!

FAQ about Cryptocurrency as an Online Payment Method: Potential and Challenges

What is cryptocurrency?

Cryptocurrency is digital or virtual money that uses cryptography for security. It’s decentralized, meaning it’s not controlled by any government or bank.

How can I use cryptocurrency for online payments?

You can use it through a digital wallet or exchange platform that allows you to send and receive cryptocurrency. Some businesses directly accept crypto payments.

What are the benefits of using cryptocurrency for online payments?

Benefits include lower transaction fees compared to traditional methods, faster processing times, and increased privacy. It can also facilitate international transactions more easily.

What are the challenges of using cryptocurrency for online payments?

Challenges include price volatility, security risks (like hacking and scams), limited acceptance by businesses, and regulatory uncertainty.

Is cryptocurrency a safe payment method?

While the technology itself is secure, the surrounding ecosystem can be risky. Scams, exchange hacks, and loss of private keys can lead to loss of funds.

Are cryptocurrency transactions reversible?

Generally, no. Once a transaction is confirmed on the blockchain, it cannot be reversed. This makes it crucial to double-check recipient addresses.

What are the most popular cryptocurrencies for online payments?

Bitcoin, Ethereum, and stablecoins (like Tether and USD Coin) are among the most commonly used for online payments.

Do I need a special account to use cryptocurrency?

Yes, you’ll need a digital wallet to store and manage your cryptocurrency. You might also need an account on an exchange to buy and sell it.

Are there any fees associated with cryptocurrency payments?

Yes, there are typically transaction fees, although they are often lower than traditional payment methods. These fees can vary depending on the cryptocurrency and network congestion.

How is cryptocurrency regulated for online payments?

Regulations vary greatly from country to country. Some have embraced it, while others have imposed restrictions or outright bans. It’s important to be aware of the regulations in your jurisdiction.