Hey there, Game Kreatif! Ever found yourself juggling cash, cards, and phone apps while making a purchase? We live in a world where paying for goods and services can be done in a blink of an eye, thanks to the rise of online payment systems. But with this digital revolution comes the question: are online payments truly superior to traditional methods? This article dives deep into the pros and cons of online payment compared to traditional methods, helping you navigate this ever-evolving financial landscape. We’ll explore everything from security concerns to convenience factors, so buckle up!

Let’s face it, choosing how to pay can sometimes feel overwhelming. Do you swipe your credit card, tap your phone, or count out cold hard cash? Understanding the advantages and disadvantages of both online and traditional payment methods is crucial for making informed decisions that suit your lifestyle and financial needs. This detailed exploration of the pros and cons of online payment compared to traditional methods aims to equip you with the knowledge you need to make the best choice for every transaction.

Speed and Convenience: The Race Against Time

Online Payments: Instant Gratification

Online payments offer unparalleled speed and convenience. With a few taps on your smartphone or clicks on your computer, you can complete transactions in seconds, anytime, anywhere. This eliminates the need to physically visit stores or banks, saving you valuable time and effort. Imagine buying groceries online while commuting or paying bills from the comfort of your couch – online payments make it all possible.

Traditional Methods: The Steady Pace

Traditional payment methods, like cash and checks, can be slower and less convenient. Paying with cash requires having the exact amount on hand, while checks require processing time and can be subject to delays. While these methods still hold their place, they often lack the speed and flexibility offered by online payments.

Security: Protecting Your Hard-Earned Money

Online Payments: Navigating the Digital Risks

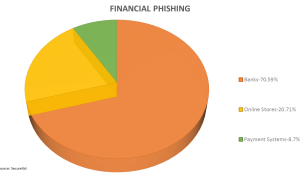

The security of online payments is a major concern for many. While technology offers advanced security measures like encryption and two-factor authentication, risks like hacking and data breaches still exist. It’s crucial to choose reputable platforms and exercise caution when sharing financial information online.

Traditional Methods: Tangible Security, Physical Risks

Traditional methods offer a sense of tangible security, as physical cash or checks are less susceptible to cyberattacks. However, they come with their own set of risks, such as theft or loss. Carrying large amounts of cash can be dangerous, and misplaced checks can lead to financial complications.

Global Reach and Accessibility: Breaking Down Borders

Online Payments: Connecting the World

One of the biggest advantages of online payment is its global reach. You can send and receive money across borders with ease, making international transactions seamless. This is particularly beneficial for businesses operating in multiple countries or individuals sending remittances to family and friends abroad.

Traditional Methods: Limited by Geography

Traditional methods often face geographical limitations. Carrying cash across borders can be cumbersome and subject to restrictions. International checks can take a long time to clear and often involve high fees.

The Cost of Convenience: Fees and Charges

Online Payments: Transaction Fees Decoded

While online payments offer convenience, they often come with transaction fees. These fees can vary depending on the payment platform and the amount being transacted. It’s essential to understand the fee structure before choosing an online payment method.

Traditional Methods: Hidden Costs

Traditional methods might appear fee-free at first glance, but hidden costs can exist. For example, using ATMs outside your network can incur charges, and bounced checks can result in hefty fees.

Record Keeping and Tracking: Managing Your Finances

Online Payments: Digital Footprints

Online payments provide detailed transaction histories, making it easy to track your spending and manage your finances. This digital record-keeping can be invaluable for budgeting and tax purposes.

Traditional Methods: The Paper Trail

Traditional methods rely on physical receipts and bank statements for record-keeping. This can be cumbersome and prone to errors, especially for individuals who make frequent transactions.

Acceptance and Availability: Where Can You Pay?

Online Payments: Growing Acceptance

Online payments are becoming increasingly accepted by businesses worldwide. From small online stores to large multinational corporations, more and more merchants are embracing digital payment options.

Traditional Methods: Still Widely Accepted

Traditional methods remain widely accepted, especially for smaller transactions or in regions with limited internet access. Cash is still king in many parts of the world.

User Experience: Ease of Use and Accessibility

Online Payments: Streamlined Transactions

Online payments often provide a seamless and user-friendly experience. Intuitive interfaces and mobile apps make it easy to send and receive money with just a few taps.

Traditional Methods: Familiar and Simple

Traditional methods offer a familiar and simple experience, particularly for those less tech-savvy. Paying with cash or writing a check requires no special skills or equipment.

Dispute Resolution: Dealing with Problems

Online Payments: Buyer Protection and Chargebacks

Online payment platforms often offer buyer protection and chargeback mechanisms for disputed transactions. This provides a layer of security for consumers in case of fraud or unsatisfactory purchases. Understanding the pros and cons of online payment compared to traditional methods means knowing how to resolve issues.

Traditional Methods: Limited Recourse

Traditional methods can offer limited recourse in case of disputes. Retrieving lost cash is often impossible, and resolving issues with checks can be time-consuming and complicated.

The Future of Payments: Trends and Predictions

The landscape of payments is constantly evolving. New technologies like contactless payments and mobile wallets are gaining popularity, blurring the lines between online and traditional methods. Understanding the pros and cons of online payment compared to traditional methods requires keeping an eye on emerging trends.

Table Breakdown: Online Payments vs. Traditional Methods

| Feature | Online Payment | Traditional Methods (Cash/Check) |

|---|---|---|

| Speed | Instant | Slower |

| Convenience | High | Lower |

| Security | Susceptible to cyber threats | Risk of loss or theft |

| Global Reach | Excellent | Limited |

| Cost | Transaction fees may apply | Potential hidden costs (ATM fees) |

| Record Keeping | Digital, easy tracking | Paper-based, can be cumbersome |

| Acceptance | Increasingly widespread | Widely accepted, but declining |

| User Experience | User-friendly, often mobile-first | Familiar, simple |

| Dispute Resolution | Buyer protection, chargebacks | Limited recourse |

Conclusion

We’ve journeyed through the key pros and cons of online payment compared to traditional methods, exploring everything from speed and security to global reach and user experience. Ultimately, the best payment method depends on your individual needs and preferences. Choosing between online and traditional payments requires careful consideration of the various factors discussed. Hopefully, this comprehensive look at the pros and cons of online payment compared to traditional methods has empowered you to make informed decisions about how you pay. Be sure to check out our other articles for more insightful information on personal finance and technology!

FAQ about Pros and Cons of Online Payment Compared to Traditional Methods

What are the pros of online payment?

It’s convenient! You can pay anytime, anywhere, without needing physical cash or checks.

What are the cons of online payment?

Security concerns are a big one. There’s a risk of fraud and data breaches. Also, not everyone has internet access or is comfortable using online platforms.

What are the pros of traditional payment methods?

They’re tangible. You physically exchange cash or a check, which can be reassuring for some. Also, no internet connection is required.

What are the cons of traditional payment methods?

It’s less convenient. You need to have cash on hand or write and mail a check. It’s also slower than online payments.

Is online payment faster than traditional methods?

Yes, generally. Transactions are processed electronically, which is much quicker than mailing checks or visiting a physical location.

Is online payment more secure than traditional methods?

Not necessarily. While advanced security measures exist, online payments are susceptible to hacking and fraud. Traditional methods have their own risks like theft or loss.

Which payment method is better for budgeting?

Online payments can be better for budgeting as you can easily track your spending history online. However, it can also lead to overspending if you’re not careful. Traditional methods can be helpful for sticking to a cash budget.

What if I don’t have a bank account, can I still use online payment?

Some online payment methods don’t require a bank account, like prepaid cards or mobile wallets. However, most do.

Are there fees associated with online payments?

Sometimes. Certain platforms or services might charge transaction fees. Always check the terms and conditions.

Which method is best for me?

It depends on your individual needs and preferences. Consider your comfort level with technology, security concerns, and convenience factors when choosing a payment method.