Introduction

Hey there, Game Kreatif! Choosing the right payment gateway can feel like navigating a maze, right? With so many options out there, each boasting different features, fees, and integrations, it’s easy to get overwhelmed. But don’t worry, we’re here to help you break it down.

This article dives deep into the world of payment gateways, providing a comprehensive best payment gateway comparison so you can confidently choose the perfect solution for your business. Whether you’re a small startup or a large enterprise, understanding the nuances of each gateway is crucial for smooth transactions, happy customers, and a thriving bottom line. So, let’s get started!

Understanding Payment Gateways

What is a Payment Gateway?

Think of a payment gateway as the bridge between your customer’s payment information and your business’s bank account. It securely authorizes credit card and other digital payments, ensuring funds are transferred safely and efficiently. Choosing the right gateway is paramount for building trust with your customers and protecting your business from fraud.

Why is Choosing the Right Gateway Important?

The right payment gateway can significantly impact your business’s success. Factors like transaction fees, processing speed, security measures, and integration capabilities can all affect your bottom line and customer experience. A poorly chosen gateway can lead to lost sales, frustrated customers, and even security breaches. So, taking the time to research and compare your options is a worthwhile investment.

Key Features to Consider

When evaluating payment gateways, consider features like transaction fees (per transaction and monthly), supported payment methods (credit cards, debit cards, e-wallets), security protocols (PCI DSS compliance, fraud prevention tools), integration options (e-commerce platforms, accounting software), and customer support availability.

Top Payment Gateways: A Best Payment Gateway Comparison

PayPal

PayPal is a household name in online payments, offering a user-friendly interface and widespread acceptance. It’s a great option for small businesses and startups due to its easy setup and low transaction fees for smaller volumes. However, as your business grows, the fees can become less competitive.

Stripe

Stripe is a developer-friendly platform known for its robust API and customizable features. It’s a popular choice for larger businesses and e-commerce platforms that require more control over their payment processing. Stripe offers a wide range of integrations and advanced fraud prevention tools.

Square

Square is a versatile platform that caters to both online and brick-and-mortar businesses. It offers point-of-sale systems, online payment processing, and even invoicing tools. Square’s pricing is transparent and straightforward, making it a good option for businesses of all sizes.

Authorize.Net

Authorize.Net is a veteran in the payment processing industry, offering reliable and secure payment solutions. It’s a solid choice for businesses looking for a trusted provider with a long track record. Authorize.Net integrates with a wide range of e-commerce platforms and offers robust reporting features.

Worldpay

Worldpay, from FIS, is a global payment processing giant, catering to businesses of all sizes worldwide. It offers a comprehensive suite of payment solutions, including online payments, point-of-sale systems, and fraud management tools. Worldpay is a good option for businesses with international operations.

Choosing the Right Gateway for Your Business

Business Size and Transaction Volume

Your business size and transaction volume play a crucial role in determining the most cost-effective gateway. High-volume businesses may benefit from negotiating lower per-transaction fees with providers like Stripe or Worldpay. Smaller businesses might find PayPal or Square more suitable.

Industry and Target Audience

Consider your industry and target audience when choosing a gateway. Some gateways specialize in specific industries, like B2B or subscription-based businesses. Ensure the gateway you choose supports the preferred payment methods of your target audience.

Integration Needs

Think about your existing software and platforms. Choose a gateway that seamlessly integrates with your e-commerce platform, accounting software, and other business tools. This will streamline your operations and improve efficiency. This Best Payment Gateway Comparison aims to provide a solid foundation for your decision.

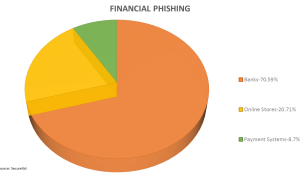

Security and Fraud Prevention

Security is paramount when it comes to payment processing. Look for gateways that are PCI DSS compliant and offer robust fraud prevention tools. This protects your business and your customers’ sensitive information.

Best Payment Gateway Comparison Table

| Feature | PayPal | Stripe | Square | Authorize.Net | Worldpay |

|---|---|---|---|---|---|

| Transaction Fees | Variable | Variable | Variable | Variable | Variable |

| Monthly Fees | Varies by plan | Varies by plan | Varies by plan | Varies by plan | Varies by plan |

| Supported Payment Methods | Major credit/debit cards, PayPal | Major credit/debit cards, Apple Pay, Google Pay | Major credit/debit cards, Apple Pay, Google Pay | Major credit/debit cards | Major credit/debit cards, various alternative payment methods |

| PCI DSS Compliant | Yes | Yes | Yes | Yes | Yes |

| Integrations | Many | Extensive | Many | Many | Extensive |

| Customer Support | 24/7 | 24/7 | 24/7 | 24/7 | 24/7 |

Conclusion

Finding the best payment gateway for your business requires careful consideration of your specific needs and priorities. This best payment gateway comparison has provided a detailed overview of some of the leading options available. Remember to weigh the factors discussed, including transaction fees, features, security, and integrations, to make an informed decision. We hope this best payment gateway comparison helps you navigate the complexities of online payment processing.

For more insights on e-commerce and business growth, check out our other articles on [Link to another article] and [Link to another article]. We’re constantly updating our content to provide you with the latest information and resources. Good luck, Game Kreatif!

FAQ about Best Payment Gateway Comparison: Which One is Right for Your Business?

What is a payment gateway?

A payment gateway is like a digital cashier. It securely authorizes credit card and other online payments for businesses. Think of it as the bridge between your customer’s bank and your business bank account.

Why do I need a payment gateway for my online business?

You need a payment gateway to accept online payments. Without one, customers can’t buy anything from your website or app.

What are some popular payment gateways?

Some popular options include PayPal, Stripe, Square, Authorize.Net, and Braintree.

How do I choose the right payment gateway?

Consider your business size, transaction volume, average transaction value, and the types of payments you need to accept (e.g., credit cards, debit cards, e-wallets). Also, compare pricing and features.

What are the typical fees associated with payment gateways?

Payment gateways usually charge per-transaction fees, monthly fees, and sometimes setup fees. These fees can vary based on the gateway and your processing volume.

What is PCI compliance, and why is it important?

PCI compliance refers to the Payment Card Industry Data Security Standard. It’s a set of security standards designed to protect credit card information. Choosing a PCI-compliant gateway helps safeguard your customers’ data and reduces your liability.

Do all payment gateways accept all currencies?

No, not all payment gateways support all currencies. Check with the specific gateway to see if it supports the currencies you need.

Can I use multiple payment gateways?

Yes, you can use multiple payment gateways for your business, giving your customers more payment options.

What is the difference between a payment gateway and a payment processor?

A payment gateway authorizes the payment, while a payment processor actually moves the money from the customer’s bank to your bank account. Think of the gateway as the authorization and the processor as the transfer.

How do I integrate a payment gateway into my website or app?

Most payment gateways offer APIs and documentation to help you integrate them into your website or app. Some platforms also have built-in integrations with popular gateways.