Hey there, Game Kreatif! Welcome to this deep dive into the world of online payment security. With the ever-growing popularity of online shopping and digital transactions, it’s more important than ever to be aware of the potential risks and know how to protect yourself from fraud. This article will arm you with practical tips and strategies to navigate the online payment landscape safely and confidently. So, grab your favorite beverage, settle in, and let’s get started!

Section 1: Building a Fortress Around Your Accounts

Choosing Strong Passwords: Your First Line of Defense

A strong password is like a sturdy lock on your front door. It’s the first line of defense against unauthorized access. Avoid using easily guessable passwords like “password123” or your birthday. Instead, opt for a combination of uppercase and lowercase letters, numbers, and symbols. A good password manager can help you generate and store complex passwords securely.

Enabling Two-Factor Authentication: Double the Protection

Two-factor authentication (2FA) adds an extra layer of security to your accounts. Even if someone manages to steal your password, they’ll still need a second form of verification, such as a code sent to your phone, to access your account. This significantly reduces the risk of unauthorized access. Many websites and apps offer 2FA, and it’s highly recommended to enable it whenever possible.

Keeping Your Software Updated: Patching the Holes

Regularly updating your operating system, web browser, and antivirus software is crucial for online payment security. These updates often include security patches that fix vulnerabilities that hackers could exploit. Think of it like patching holes in your fence to keep unwanted guests out.

Section 2: Recognizing and Avoiding Phishing Scams

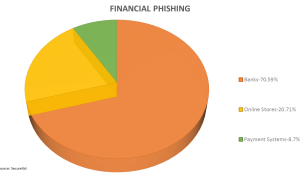

Spotting the Red Flags: Identifying Phishing Attempts

Phishing scams are designed to trick you into revealing sensitive information like your login credentials or credit card details. Be wary of emails, text messages, or pop-ups that ask for personal information or urge you to click on suspicious links. Look for red flags like misspellings, grammatical errors, and unfamiliar email addresses.

Verifying Website Authenticity: Look for the Lock

Before entering any sensitive information on a website, always check the URL. Make sure the website address starts with “https” and that there’s a padlock icon in the address bar. This indicates that the website is using a secure connection and your data will be encrypted. Security in Online Payment: Tips to Avoid Fraud should be your mantra.

Trusting Your Gut: When Something Feels Off

Sometimes, your gut feeling can be your best defense against online fraud. If something feels off about a website, email, or text message, trust your instincts and avoid clicking on any links or providing any personal information. It’s always better to be safe than sorry.

Section 3: Secure Payment Practices for Peace of Mind

Utilizing Virtual Credit Card Numbers: Masking Your Real Information

Virtual credit card numbers are temporary, randomly generated numbers that mask your real credit card information. This adds an extra layer of security to your online transactions, as hackers won’t be able to access your actual credit card details even if they manage to intercept your payment information.

Opting for Secure Payment Gateways: Trusted Intermediaries

When making online purchases, choose reputable payment gateways like PayPal, Stripe, or Apple Pay. These gateways offer secure payment processing and buyer protection, ensuring that your transactions are safe and secure. Security in Online Payment: Tips to Avoid Fraud is paramount, and these gateways help achieve that.

Monitoring Your Accounts Regularly: Staying Alert

Regularly monitoring your bank and credit card statements is crucial for detecting any unauthorized transactions. Set up alerts to notify you of any unusual activity. The quicker you identify and report fraudulent transactions, the less likely you are to suffer significant financial losses.

Limiting Public Wi-Fi Usage for Sensitive Transactions: Protecting Your Data

Public Wi-Fi networks can be risky for online transactions. Avoid using public Wi-Fi for sensitive activities like online banking or shopping. If you must use public Wi-Fi, use a virtual private network (VPN) to encrypt your connection and protect your data.

Section 4: Comparison of Payment Security Methods

| Feature | Credit Card | Debit Card | PayPal | Apple Pay |

|---|---|---|---|---|

| Fraud Protection | High | Moderate | High | High |

| Purchase Disputes | Easy | More Difficult | Easy | Easy |

| Transaction Fees | Varies | Usually None | Varies | None |

| Security Features | CVV, Expiration Date, 2FA | PIN, 2FA | 2FA, Buyer Protection | Biometric Authentication, Tokenization |

| Acceptance | Wide | Wide | Less Wide than Cards | Growing Acceptance |

Conclusion

We’ve covered a lot of ground on security in online payment: tips to avoid fraud. By implementing these strategies, you can significantly reduce your risk of becoming a victim of online fraud. Remember, staying informed and vigilant is key to protecting yourself in the digital age. Be sure to check out our other articles on cybersecurity and online safety for more helpful tips and advice. Thanks for reading, Game Kreatif!

FAQ about Security in Online Payment: Tips to Avoid Fraud

What is online payment fraud?

Online payment fraud happens when someone steals your payment information (like your credit card number) and uses it to make unauthorized purchases online.

How can I protect my credit card information online?

Only shop on secure websites (look for “https” in the address bar and a padlock icon). Avoid storing your credit card details on websites unless absolutely necessary.

What is a strong password, and why is it important for online payments?

A strong password is long, complex, and unique. It should include a mix of uppercase and lowercase letters, numbers, and symbols. A strong password makes it harder for hackers to access your accounts and steal your payment information.

What is two-factor authentication, and should I use it?

Two-factor authentication adds an extra layer of security. Even if someone gets your password, they’ll need a second code (usually sent to your phone) to access your account. You should definitely use it whenever possible.

Are public Wi-Fi networks safe for online payments?

Public Wi-Fi networks are generally not secure for online payments. Hackers can intercept your information on these networks. Use a VPN or avoid making payments on public Wi-Fi.

What is phishing, and how can I avoid it?

Phishing is when scammers try to trick you into giving them your personal information (like your password or credit card number) by pretending to be a legitimate company. Be wary of suspicious emails, text messages, or websites asking for your information.

What should I do if I think my credit card has been compromised?

Contact your bank or credit card company immediately to report the suspected fraud and block your card. Monitor your account statements for unauthorized charges.

How can I identify a fake shopping website?

Look for poor grammar and spelling, unclear contact information, and unusually low prices. Check online reviews and verify the website’s security certificate (look for the padlock icon).

Is it safe to use mobile payment apps?

Mobile payment apps can be safe if you use them responsibly. Make sure your phone is secure with a strong password and up-to-date software. Use official app stores to download payment apps.

What are some other general tips for safe online payments?

Keep your software updated, use antivirus software, be cautious of clicking on links in emails or texts, and regularly monitor your bank and credit card statements for unauthorized activity.