Hey there, Game Kreatif! Ready to dive into the world of online payments? In today’s digital age, having a smooth and secure checkout experience is crucial for any online business. And for shoppers, it’s all about convenience and trust. That’s why we’re breaking down the 10 most popular online payment methods this year, so you can stay informed and make the best choices for your online transactions. Whether you’re a business owner looking to optimize your checkout process or a shopper curious about the latest payment trends, this article has got you covered.

Digital Wallets: The Reigning Champions

The Rise of Mobile Payments

Digital wallets have undoubtedly revolutionized how we pay online. With the tap of a button or a quick scan, transactions are completed in seconds. This convenience, combined with enhanced security features, has propelled digital wallets to the forefront of online payment methods. Think Apple Pay, Google Pay, and Samsung Pay – these giants have made mobile payments mainstream. They’re now accepted almost everywhere, from your local coffee shop to large e-commerce platforms.

PayPal: A Global Powerhouse

PayPal remains a dominant force in the online payment landscape. Its widespread acceptance and user-friendly interface make it a popular choice for both businesses and consumers. Millions of transactions are processed through PayPal every day, highlighting its reliability and global reach. Plus, its buyer and seller protection policies offer an added layer of security, further solidifying its position as a top payment method.

Credit and Debit Cards: The Old Faithfuls

Visa and Mastercard: Still on Top

Despite the rise of digital wallets, credit and debit cards remain staples in the online payment world. Visa and Mastercard, in particular, continue to be the most widely accepted card networks globally. Their established infrastructure and robust security measures make them trusted options for online shoppers. Plus, the rewards programs offered by many credit card companies are a big draw for consumers.

The Emerging Role of Virtual Cards

Virtual cards are gaining traction as a secure way to shop online. These digitally generated card numbers add an extra layer of security, protecting your actual card details from potential fraud. They’re often single-use or have spending limits, offering greater control over your online transactions. This added security is especially appealing in today’s digital age, where data breaches are a growing concern.

The Future of Online Payments: Beyond the Basics

Cryptocurrency Payments: Gaining Momentum

Cryptocurrencies like Bitcoin and Ethereum are slowly but surely making their way into the mainstream online payment space. While still relatively new, their decentralized nature and potential for lower transaction fees are attracting both businesses and consumers. As more platforms begin to accept cryptocurrencies, we can expect to see further growth in this area. The 10 most popular online payment methods this year are certainly being influenced by this emerging trend.

Buy Now, Pay Later (BNPL) Services: A Growing Trend

BNPL services have become increasingly popular, especially among younger shoppers. These services allow customers to split their purchases into smaller, interest-free installments, making larger purchases more manageable. While convenience is a major selling point, it’s important to use these services responsibly to avoid accumulating debt. The 10 most popular online payment methods this year increasingly include BNPL options.

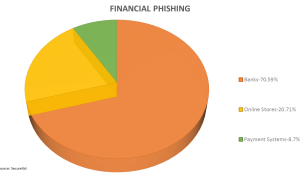

The Importance of Secure Payment Gateways

No matter which payment method you choose, secure payment gateways are essential for protecting sensitive financial information. Gateways like Stripe and Authorize.Net encrypt data and ensure compliance with industry security standards, providing peace of mind for both businesses and consumers. Secure gateways are a fundamental part of the 10 most popular online payment methods this year.

Contactless Payments: Tap and Go

The convenience of contactless payments, using near-field communication (NFC) technology, has translated seamlessly into the online world. With a quick tap of your phone or smartwatch, payments can be processed quickly and securely. This trend is expected to continue growing as more devices become NFC-enabled.

Biometric Authentication: Added Security

Biometric authentication methods, such as fingerprint scanning and facial recognition, are becoming increasingly common for online payments. These methods provide an extra layer of security, making it more difficult for unauthorized users to access your accounts.

Open Banking and API Integration: Streamlining Transactions

Open banking and API integration are revolutionizing how online payments are processed. By allowing third-party apps to access financial data securely, these technologies are streamlining transactions and enabling innovative new payment solutions.

Table Breakdown: 10 Most Popular Online Payment Methods This Year

| Payment Method | Pros | Cons |

|---|---|---|

| Digital Wallets | Convenient, Secure, Widely Accepted | Requires compatible device |

| PayPal | Global Reach, Buyer/Seller Protection, User-Friendly | Fees for some transactions |

| Visa/Mastercard | Widely Accepted, Rewards Programs | Potential for fraud |

| Virtual Cards | Enhanced Security, Spending Limits | Limited Acceptance |

| Cryptocurrency | Decentralized, Potential for Lower Fees | Volatility, Limited Acceptance |

| BNPL Services | Increased Affordability, Interest-Free Installments | Potential for Debt Accumulation |

| Contactless Payments | Speed and Convenience | Requires NFC-enabled device |

| Biometric Authentication | Enhanced Security | Privacy Concerns |

| Open Banking/API | Streamlined Transactions, Innovation | Security Risks if not implemented correctly |

| Secure Payment Gateways | Essential for Data Protection | Can be costly for businesses |

Conclusion

So there you have it, Game Kreatif – a comprehensive look at the 10 most popular online payment methods this year. The landscape is constantly evolving, with new technologies and trends emerging all the time. By staying informed about the latest developments, you can make smarter choices about how you pay and get paid online. Want to learn more about specific payment methods? Check out our other articles on [link to related article 1], [link to related article 2], and [link to related article 3].

FAQ about 10 Most Popular Online Payment Methods This Year

What are the most popular online payment methods this year?

The most popular methods tend to vary by region, but generally include digital wallets (like PayPal, Apple Pay, Google Pay), credit and debit cards (Visa, Mastercard, American Express), buy now pay later services (Klarna, Affirm), bank transfers, and occasionally cryptocurrencies.

What is a digital wallet?

A digital wallet stores your payment information securely on your phone or computer. Instead of entering your card details every time, you can pay with a click or tap.

Are digital wallets safe?

Generally, yes. They often use additional security measures like tokenization and biometric authentication (fingerprint, face ID) to protect your information.

What is Buy Now, Pay Later (BNPL)?

BNPL services let you split your purchase into smaller, interest-free installments. It’s like a short-term loan offered at checkout.

Are there fees with BNPL?

While often interest-free, BNPL services can charge late fees if you miss a payment. It’s crucial to read the terms and conditions.

What’s the difference between a credit card and a debit card?

Credit cards let you borrow money to make purchases, while debit cards use funds directly from your bank account.

Which payment method is fastest?

Digital wallets and credit/debit cards are generally the fastest, offering instant payment processing.

Which payment method is the most secure?

All reputable payment methods have robust security measures. However, methods with additional authentication like two-factor authentication or biometric login offer enhanced security.

Can I use these payment methods internationally?

Many payment methods, particularly credit/debit cards and digital wallets like PayPal, can be used internationally. However, check for any associated fees.

How do I choose the best online payment method?

The best method depends on your needs and preferences. Consider factors like security, convenience, speed, fees, and availability in your region.