Introduction

Hey there, Game Kreatif! Buckle up, because we’re about to dive headfirst into the exciting world of insurance – and how technology is turning it on its head. Forget dusty filing cabinets and endless paperwork; the future of insurance is sleek, personalized, and powered by innovation. We’re talking about a seismic shift, from how policies are assessed and priced to how claims are filed and processed.

This article explores the dynamic intersection of insurance and technology, examining the key trends shaping the future of insurance: how technology is changing the industry, and what it means for businesses and consumers alike. Get ready to discover how artificial intelligence, blockchain, the Internet of Things, and more are revolutionizing the insurance landscape, creating a more efficient, transparent, and customer-centric experience.

Section 1: The Rise of AI in Insurance

AI-Powered Risk Assessment

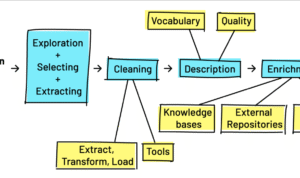

Artificial intelligence is rapidly transforming how insurance companies assess risk. Traditional methods often relied on broad demographics and historical data, but AI allows for a much more granular and personalized approach. By analyzing vast datasets, including individual behaviors, lifestyle choices, and even social media activity, AI algorithms can pinpoint risk factors with greater accuracy. This means fairer pricing, more customized policies, and a better understanding of individual needs.

This granular approach also helps prevent fraud. AI can identify suspicious patterns and anomalies that might otherwise slip through the cracks, protecting both insurers and policyholders from fraudulent claims.

Automating Claims Processing

Forget endless phone calls and paperwork – AI is automating the claims process, making it faster and more efficient than ever. From first notice of loss to final settlement, AI can handle many of the tedious tasks involved in claims processing, freeing up human adjusters to focus on more complex cases. This not only speeds up the process but also reduces costs and improves customer satisfaction.

Imagine filing a claim with a simple photo upload from your smartphone, receiving an instant assessment, and having the funds deposited into your account within hours. This is the power of AI in claims processing, streamlining the experience and minimizing the hassle for policyholders.

Personalized Insurance Products

Thanks to AI, the future of insurance: how technology is changing the industry, is also about personalization. AI algorithms analyze individual data to create customized insurance products tailored to specific needs and budgets. No longer are consumers limited to one-size-fits-all policies; they can now choose coverage that aligns perfectly with their lifestyle and risk profile.

Imagine a fitness enthusiast receiving discounts on health insurance for maintaining a healthy lifestyle, or a safe driver getting rewarded with lower car insurance premiums. This is the future of insurance, powered by the personalized insights of AI.

Section 2: The Impact of the Internet of Things (IoT)

Connected Devices and Risk Management

The Internet of Things (IoT) is creating a world of interconnected devices, from smart homes and wearables to connected cars and industrial sensors. This explosion of data offers insurers a wealth of information to better understand and manage risk. For example, data from connected home devices can help prevent burglaries and fires, while data from wearable fitness trackers can incentivize healthy behaviors and reduce health insurance premiums.

This constant stream of data allows for proactive risk management, enabling insurers to identify potential problems before they occur and offer preventative measures to mitigate risk.

Usage-Based Insurance

IoT devices also enable usage-based insurance (UBI), where premiums are determined by actual behavior rather than generalized statistics. For example, connected car data can track driving habits, rewarding safe drivers with lower premiums and providing feedback to improve driving behavior. This promotes safer roads and fairer pricing.

Similarly, health insurance premiums can be adjusted based on data from fitness trackers, encouraging healthier lifestyles and potentially lowering healthcare costs.

Predictive Maintenance and Reduced Losses

In commercial insurance, IoT sensors can monitor equipment and machinery in real-time, enabling predictive maintenance and preventing costly breakdowns. This not only minimizes disruptions to business operations but also reduces the likelihood of accidents and insurance claims.

By anticipating potential problems and taking preventative measures, insurers can play a proactive role in minimizing losses and promoting safer work environments.

Section 3: Blockchain and the Future of Insurance

Secure and Transparent Transactions

Blockchain technology offers a secure and transparent platform for managing insurance transactions. Its decentralized and immutable nature ensures that all records are tamper-proof, reducing the risk of fraud and enhancing trust between insurers and policyholders. This also streamlines the claims process, making it faster and more efficient.

Imagine a world where claims are automatically verified and processed through secure blockchain networks, eliminating the need for lengthy investigations and paperwork. This is the potential of blockchain in insurance.

Smart Contracts and Automated Claims

Smart contracts, self-executing agreements written in code, can automate various aspects of the insurance process. For instance, a smart contract could automatically trigger a payout in the event of a flight delay or a natural disaster, based on pre-defined parameters. This eliminates the need for manual intervention, speeding up the claims process and reducing administrative costs.

This automation also improves transparency, as all parties involved can access the terms and conditions of the smart contract, ensuring clarity and accountability.

Streamlining KYC/AML Compliance

Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance are crucial aspects of the insurance industry. Blockchain can streamline these processes by providing a secure and transparent platform for verifying customer identities and tracking transactions. This not only reduces compliance costs but also strengthens security measures against fraud and illicit activities.

By leveraging the power of blockchain, insurers can enhance their KYC/AML efforts, fostering a safer and more compliant environment.

Table Breakdown: Technology’s Impact on Insurance

| Technology | Impact on Insurance | Benefits |

|---|---|---|

| Artificial Intelligence (AI) | Automated claims processing, personalized risk assessment, fraud detection | Faster claims, fairer pricing, improved customer experience |

| Internet of Things (IoT) | Usage-based insurance, predictive maintenance, proactive risk management | Lower premiums for safe behavior, reduced losses, improved safety |

| Blockchain | Secure transactions, smart contracts, streamlined KYC/AML compliance | Increased transparency, reduced fraud, automated claims |

| Cloud Computing | Enhanced data storage and analysis, improved scalability, cost savings | Better decision-making, increased efficiency, reduced IT infrastructure costs |

| Big Data Analytics | Deeper insights into customer behavior and risk factors, improved pricing models | More accurate risk assessment, personalized products, better fraud detection |

Conclusion

The future of insurance: how technology is changing the industry is an ongoing evolution, promising a more personalized, efficient, and customer-centric experience. From AI-powered risk assessment to blockchain-secured transactions, technology is transforming every aspect of the insurance landscape. As we’ve explored, the potential benefits are immense, leading to fairer pricing, faster claims, and improved risk management.

We hope this deep dive into the future of insurance has been insightful. Be sure to check out our other articles exploring the exciting intersections of technology and various industries!

FAQ about The Future of Insurance: How Technology is Changing the Industry

How is technology changing insurance?

Technology is making insurance faster, cheaper, and more personalized. Think quicker claims, online policy management, and premiums based on your actual behavior.

What is Insurtech?

Insurtech is short for “insurance technology.” It refers to all the new tech companies and innovations disrupting the traditional insurance industry.

Will robots replace insurance agents?

While some tasks are being automated, human agents still play a vital role in providing advice and complex problem-solving. Technology enhances their abilities, not replaces them entirely.

How is AI used in insurance?

AI helps with fraud detection, claims processing, risk assessment, and even customer service chatbots. This allows for faster and more efficient operations.

What is usage-based insurance?

Usage-based insurance (UBI) tracks your driving or other behaviors using telematics. Safer behavior can lead to lower premiums, making it a fairer way to price insurance.

What is blockchain and how does it impact insurance?

Blockchain is a secure and transparent way to store and share data. In insurance, it can streamline claims processing, reduce fraud, and simplify policy management.

What are the benefits of digital insurance platforms?

Digital platforms offer 24/7 access to policy information, online claims filing, and personalized policy options. They make managing insurance much more convenient.

How does technology improve claims processing?

Technology automates many steps in the claims process, reducing paperwork, speeding up approvals, and getting you your money faster.

Is my data safe with insurance companies using technology?

Insurance companies invest heavily in cybersecurity to protect your data. They are subject to strict regulations regarding data privacy.

What does the future hold for insurance and technology?

The future of insurance is likely to be even more personalized, predictive, and preventative. Technology will continue to drive innovation and improve the customer experience.